Insurance

If you’re running a construction business, you already know that your ...

Loans

Credit scores are three-digit numbers that represent a person’s creditworthiness. Lenders ...

Technology

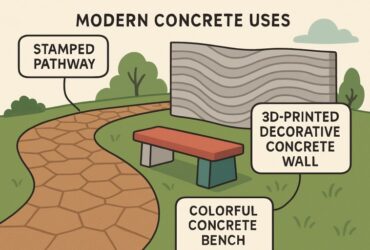

Table of Contents Introduction 3D Printing Decorative Finishes Textured Surfaces Concrete ...