Table of Contents

- Introduction

- Understand the Types of Dental Insurance Plans

- Evaluate Coverage for Preventive and Major Procedures

- Assess the Network of Dentists

- Consider Costs Beyond Premiums

- Examine Additional Benefits and Discounts

- Special Considerations for Families

- Seek Expert Advice

- Conclusion: Make an Informed Choice

Introduction

Choosing a dental insurance plan can be confusing, with a range of types, coverage levels, and network rules. By understanding essential differences and what to look for, you can ensure better dental health and effective budgeting for your family’s care. To compare plan options and begin your research, review the essential details at www1.deltadentalins.com/employers/compare-plans.html.

With so many dental insurance products on the market, it’s important not to rush your decision. Taking time to compare coverage, out-of-pocket costs, and provider networks ensures the plan you pick will help minimize costs and make getting dental care convenient. In addition, understanding what each plan type offers means fewer surprises if you need extensive dental work down the road.

It’s also wise to factor in your personal priorities—do you have kids needing braces, or simply want a plan for preventive care? Answering questions like these before you start comparing plans sets you up for a better fit and greater long-term satisfaction.

Understand the Types of Dental Insurance Plans

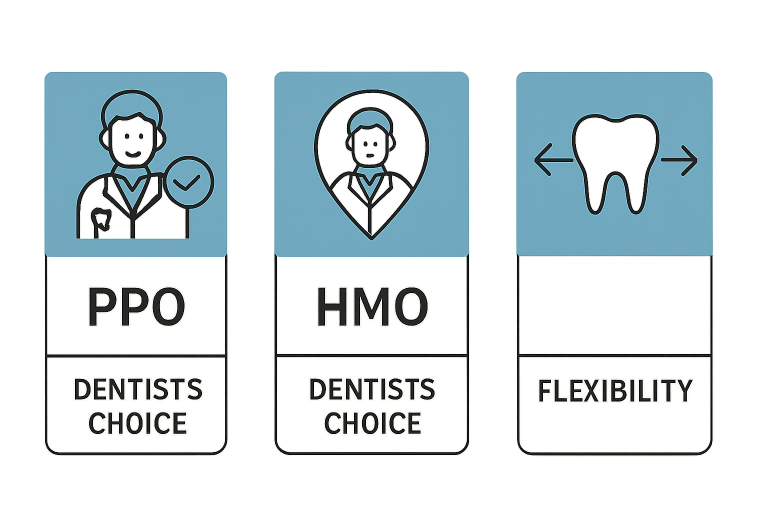

Dental insurance plans come in several primary types. Familiarize yourself with how each works to decide which is most compatible with your individual or family needs:

- Preferred Provider Organization (PPO): These plans offer flexibility, letting members see any dentist but providing the most significant savings with in-network dentists. PPOs are well-suited for those who want greater provider choice and are willing to pay a slightly higher premium.

- Health Maintenance Organization (HMO): HMOs generally require choosing a primary dentist within their network, which means lower premiums and potentially lower out-of-pocket costs. However, the provider pool is more limited, and referrals are needed for specialty services. For a deeper dive into how dental insurance works, including HMO and PPO structures, Investopedia offers a comprehensive guide.

- Indemnity Plans: Also called fee-for-service plans, indemnity options let you visit any licensed dentist. The insurer reimburses a portion of the cost, but typically, you’ll need to pay upfront and submit a claim.

Knowing these structures ensures you can quickly eliminate plans that don’t align with your preferences or anticipated dental needs.

Evaluate Coverage for Preventive and Major Procedures

Most dental insurance policies cover preventive treatments—such as exams, cleanings, and X-rays—at or near 100%. These services help you avoid bigger dental issues and costs down the line. However, coverage can vary significantly for restorative or major services, including fillings, crowns, root canals, extractions, and dentures.

Questions To Ask:

- Are major procedures covered at 50%, 60%, or a different percentage?

- Does the plan pay for both simple and complex tooth extractions?

- Is periodontic or oral surgery included?

Anticipating future dental needs reduces the likelihood you’ll be caught off guard by coverage gaps and large out-of-pocket bills.

Assess the Network of Dentists

Always confirm that your preferred providers and any dental specialists you anticipate needing are part of the plan’s network. The network of dentists and specialists directly influences your total out-of-pocket costs. Visiting in-network providers typically means your insurance will cover a larger portion of preventive care, cleanings, fillings, and other procedures. On the other hand, going out-of-network can result in significantly higher copayments, reduced coverage, or even services that your plan does not cover at all. This can create unexpected expenses, especially for major dental work or specialist consultations.

Most dental insurers provide tools to help you identify in-network providers. You can usually search online using the insurer’s website, which often includes filters by location, specialty, and patient reviews. Alternatively, you can request a printed directory before enrolling in the plan. Taking the time to verify that your regular dentist, preferred specialists, or any new providers you may need in the future are included in the network can save both time and money. Knowing your dentist is in-network also simplifies scheduling, avoids surprise bills, and provides peace of mind that your dental benefits will be maximized whenever you need care.

Consider Costs Beyond Premiums

A plan’s monthly premium isn’t the only price to consider. Carefully study:

- Deductibles: What amount must you spend before insurance begins to cover costs?

- Copayments: What is the fixed amount you pay at each visit?

- Coinsurance: What percentage of the bill are you responsible for after your deductible is met?

Understanding these features makes budgeting easier. Keep in mind that lower premiums sometimes mean higher deductibles or coinsurance, so weigh costs holistically to prevent surprises.

Examine Additional Benefits and Discounts

Many dental plans go beyond basic preventive and restorative care, offering additional benefits and discounts that can significantly reduce out-of-pocket costs. These extras often cover services typically excluded from standard policies, such as orthodontics, cosmetic dentistry, teeth whitening, or even vision care. For example, some plans may provide a percentage discount on veneers or clear aligners, while others may include partial coverage for routine eye exams and glasses.

These perks can be especially valuable if you anticipate elective procedures or want more comprehensive care without paying full market rates. It’s essential not only to confirm the availability of these benefits but also to compare their costs across different plans. Sometimes a slightly higher premium may be justified if the plan provides substantial savings on high-cost procedures or services you know you will use regularly.

Special Considerations for Families

When insuring multiple family members, coverage details for children become crucial. Look closely at whether pediatric preventive services—such as cleanings, fluoride treatments, and sealants—are fully covered, as these are foundational for long-term oral health. Additionally, investigate whether orthodontic treatments, such as braces or aligners, are included for dependent children, and whether there are age or coverage limits.

Plans that offer comprehensive family benefits often provide cost efficiencies, such as bundled premiums for multi-person policies or discounts when covering two or more dependents. Choosing a plan with strong family coverage ensures that every member, from young children to adults, receives appropriate preventive and corrective care without facing unexpected expenses. It also simplifies billing and claims processes, since the entire family is under a single policy framework.

Seek Expert Advice

Navigating dental insurance can be overwhelming, especially if you are purchasing a plan independently for the first time. Terms like annual maximums and coverage exclusions can be confusing, and even small differences between plans can have significant cost implications. Consulting a dental insurance broker or a financial advisor who specializes in healthcare coverage can help demystify the options.

Experts can evaluate your personal and family needs, clarify which services are included and which are excluded, and guide you toward the plan that offers the best balance of coverage and affordability. This guidance can prevent surprises down the line, such as denied claims or high out-of-pocket costs, ensuring that your investment in dental insurance delivers tangible benefits.

Conclusion: Make an Informed Choice

Considering additional benefits, family-specific coverage, and expert advice collectively ensures that your dental insurance aligns with your needs, budget, and lifestyle. Thoughtful evaluation of these factors helps you select a plan that protects both your dental health and your finances, providing peace of mind for you and your loved ones. By taking the time to research and compare options, you can confidently choose coverage that truly supports your family’s oral health for years to come.