The Axis Long Term Equity is a multi-cap equity mutual fund whose main objective is to generate income and a long-term capital appreciation for the investor. As this fund is a multi-cap fund, it looks for investment opportunities across all market caps. As this fund primarily invests in equity and equity-related securities it is susceptible to market volatility. The risk associated with this type of an investment is moderately high as it invests the majority of the corpus in equity and a very small margin in bonds and money market instruments to provide it with a level of security.

ELSS

The Axis Long Term Equity Fund qualifies as an Equity Linked Saving Scheme (ELSS) under section 80C of the Income Tax Act, 1961. Section 80C allows for a deduction of up to Rs. 1.5 lakh from the assessee’s income for investments in instruments within this section. ELSSs are considered some of the best tax-saving schemes as they come with the shortest lock-in period of 3-years when compared to other tax-saving schemes likes Public Provident Fund (PPF), National Saving Certificates (NSC) or Fixed Deposits (FD) and, as they are equity-based, they tend to provide the investor with superior returns. At the time of redemption of units from this scheme, long-term capital gains will be taxed as prescribed within the Income Tax Act (presently @ 10%).

Expected Returns

The Axis Long Term Equity Fund is one of the top performing ELSS mutual funds and has consistently performed strongly since its inception in 2009, it has consistently outperformed its benchmark, the S&P BSE 200, by approximately 5% since 2013 in 1 and 5-year investment horizons. There is no exit load on these funds as there is a mandatory 3-year lock-in period, which does not allow the investor to redeem units before maturity. You can use Piggy's mutual fund investment platform to invest in this fund.

Methods of Investment

Investors can invest in the Axis Long Term Equity Fund in a lump sum or through Systematic Investment Plans (SIPs). To see good results from the fund it would be advisable to increase the investment regularly over a long investment horizon to build a sizeable corpus, and to see the benefits of compounding interest. As this is an equity mutual fund it is advisable to have a long investment horizon of at least 7 to 10 years.

Investment Philosophy

The Axis Long Term Equity Fund invests in a diversified portfolio of companies that display a strong level of growth and sustainable business models. Though the benchmark for this fund is the S&P BSE 200, it is not limited to investing in companies constituting this benchmark, as the fund invests a large amount in mid-cap and small-cap companies and has a small investment in debt and other stable money market instrument to provide a level of stability as well.

Portfolio

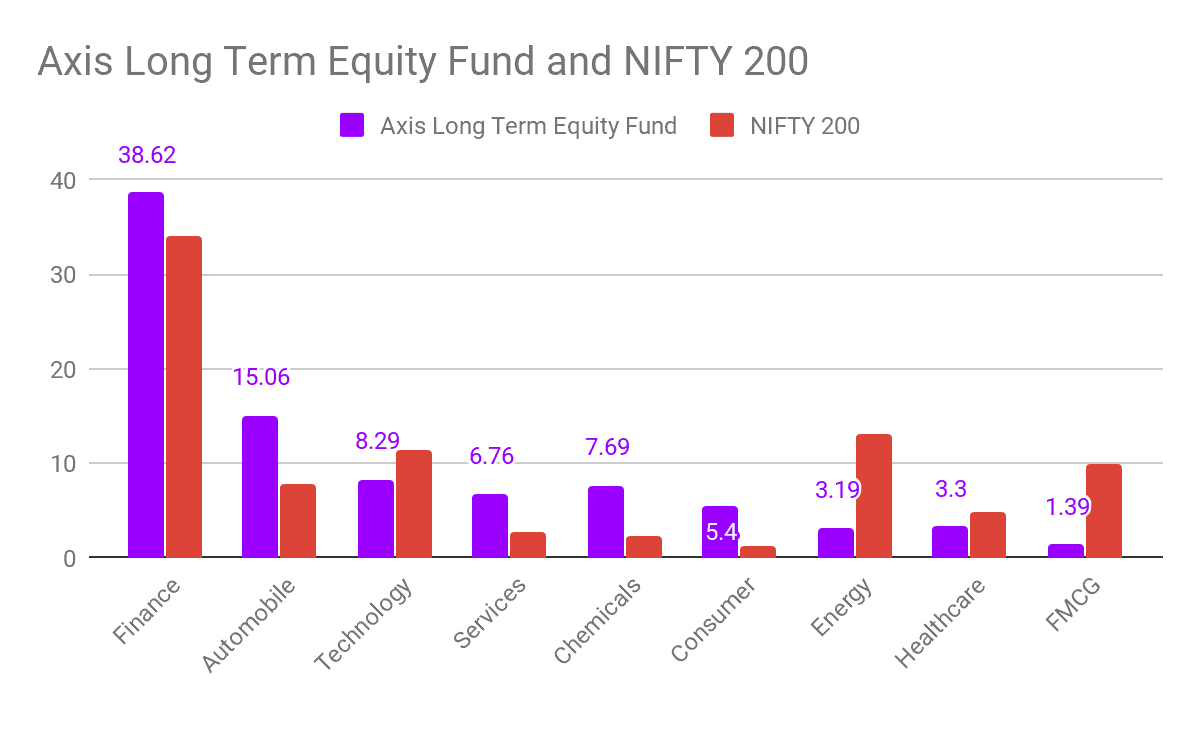

The Axis Long Term Equity Fund is an open-ended fund that primarily invests the corpus in large-cap and mid-cap companies with a small amount being invested in small-cap companies who could be market leaders in the future to bolster high returns and debt and other money market instruments to provide a level of stability to the fund. The fund presently invests the corpus across the financial, automobile, technology, chemical and service sectors. The sector allocation in comparison to the benchmark Nifty 200 has been shown in the chart below.

Sector Allocation

Top Holdings

Company | Sector | Multiple | 3Year High | 3Year Low | Asset % |

HDFC Bank | Finance | 29.84 | 9.87 | 6.96 | 8.80 |

Tata Consultancy Services | Technology | 25.96 | 9.92 | 0 | 8.29 |

Kotak Mahindra Bank | Finance | 34.05 | 8.90 | 6.59 | 6.79 |

Pidilite Industries | Chemicals | 59.27 | 6.62 | 3.56 | 6.40 |

Maruti Suzuki India | Automobile | 28.16 | 6.76 | 3.40 | 5.77 |

Bajaj Finance | Finance | 42.61 | 6.09 | 2.44 | 5.5 |

HDFC | Finance | 24.93 | 7.57 | 4.84 | 5.31 |

Gruh Finance | Finance | 47.61 | 5.03 | 2.09 | 4.08 |

Avenue Supermarts | Services | 105 | 4.37 | 0 | 4.08 |

Bandhan Bank | Finance | 33.64 | 4.13 | 0 | 3.46 |

TTK Prestige | Consumer Durables | 46.72 | 3.69 | 2.64 | 3.34 |

Eicher Motors | Automobiles | 29.06 | 3.28 | 1.32 | 3.24 |

Asset Allocation

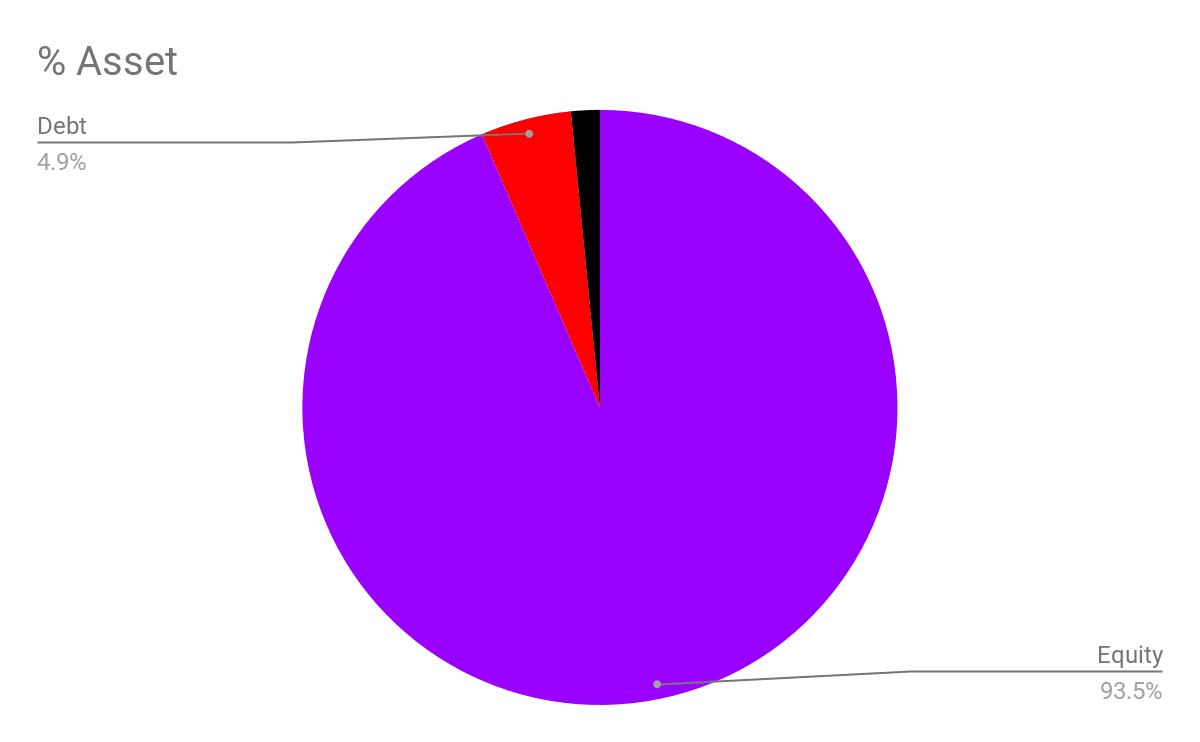

The primary focus of this fund is to provide the investor with long-term capital appreciation and income, for this reason, it primarily invests in equity and equity related instruments and a small percentage of the corpus is invested in debt and other stable money market instruments to secure the investment. Listed below is the stipulated asset allocation of the Axis Long Term Equity Fund.

Instrument | Minimum – Maximum | Risk Profile |

Equity | 80% – 100% | High |

Debt | 0 – 20% | Low – Medium |

Current Asset Allocation

Fund Managers

Mr. Jinesh Gopani

Mr. Jinesh Gopani has a total of 13 years’ experience in the capital markets of which four years have been in equity fund management. Before taking over as fund manager for the Axis Long Term Equity Fund in 2011 Mr. Gopani was a Portfolio Manager at Birla Sun Life Asset Management Company Ltd. from June 2008 till October 2009. Mr. Gopani has also served as a portfolio manager with Voyager India Capital Pvt. Ltd., and a Research Analyst with Emkay Share & Stock Brokers Ltd.

Peer Comparison

Fund | CRISIL Rating | 3Year Returns | Min SIP Investment | Min Investment | Fund Size (Cr.) |

Mirae Asset Tax Saver Fund – Direct Plan – Growth | Not Rated | 19.13% | Rs.500 | Rs.500 | Rs.1133.38 |

BOI AXA Tax Advantage Fund – Direct Plan Growth | 4 | 10.76% | Rs.500 | Rs.500 | Rs.182.75 |

IDFC Tax Advantage (ELSS) Fund – Direct Plan | 5 | 13.62% | Rs.500 | Rs.500 | Rs.1607.38 |

Aditya Birla Sun Life Tax Relief 96 Growth Direct Plan | 5 | 14.03% | Rs.500 | Rs.500 | Rs.6480.26 |